“I felt like I was coming home.”

Longtime donor Charles Williams (’02, ’10) describes his recent return to the Daytona Beach Campus as a warm reunion. As the aerospace science/safety alumnus toured an engineering lab and a human factors lab, he liked the energy of the students and the commitment of the fellow faculty members he met. Williams is an adjunct with Embry-Riddle Worldwide.

Williams earned his degree in aerospace science with a minor in safety. He has put his education to good use, working at Ronald Reagan Washington National Airport in Arlington, Virginia, and as part of the Transportation Safety Administration (TSA) where he serves as program manager for the Workplace Violence Prevention program.

On his campus tour, it felt so good to be back with his people that he decided to make an additional gift—a gift of life insurance—to his alma mater. In a first gift of its kind to the university, Williams purchased a policy and made Embry-Riddle the owner and beneficiary.

“It seemed like the right thing to do,” he says. “I was buying a life insurance policy, and I realized it gave me a way to make a bigger impact than other gifts I could afford. This option is much easier than people might realize. You could make a $100,000 gift by just paying $200 a month for five years. It’s a no-brainer.”

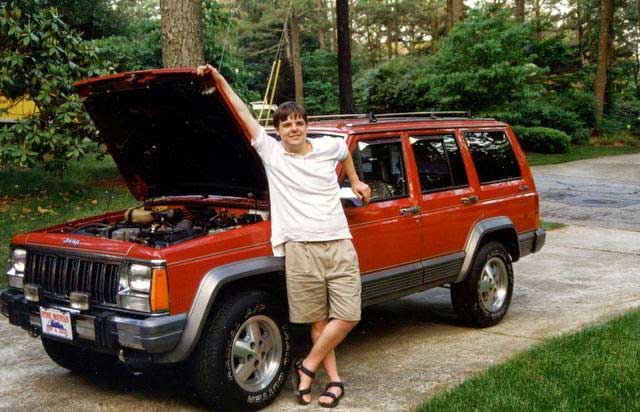

This kind of creative giving is not new to Williams. An earlier gift to Embry-Riddle came from the proceeds of restoring and selling a 1988 Jeep Cherokee.

According to Assistant Vice President for Philanthropy Travis Grantham, “Life insurance gifts are a great way to use future funds to grow endowment accounts to accomplish a donor’s wishes.”

Williams has not decided specifically how he will direct his gift, but he knows he wants the money to help students, possibly through scholarships.

“When the ink’s dry on the contract, I’ll make another trip to campus and get inspired all over again,” he says.